There is a Serious Problem with the BA’s Definition of “Craft Beer”

Late last year my team and I had a chance meeting with two Brewers Association (BA) executives in a brewery. This is not the start of a bad joke — it is how I learned about a serious problem with the BA and the huge opportunity I see in the craft beer industry.

After a couple of beers and some serious conversation we understood that the BA is not focused on the +80% of beer drinkers that don’t drink craft beer, and that protecting craft beer’s 12.7% of independent market share from AB-InBev is their primary goal. According to these BA folks, Anheuser-Busch is absolutely determined to put independent craft breweries out of business.

We believe this vision is flawed and out of sync with reality. It is based in empty rhetoric and fear that harms rather than helps independent craft breweries and keeps good ideas from finding the light of day. Below we describe why this is true, and we start by getting quite blunt about what craft beer is and who is making it.

What is craft beer? We all know it’s not fizzy, yellow water. Instead, it’s the “Premium Beer” that we all love as beer drinkers, regardless of who makes it. A “craft brewer” is someone or some firm that is engaged in producing it. This is not the BA’s “definition” which seems to change subject to political or economic necessity. Our inclusive definition of craft beer provides a view of the industry landscape from a broad and open perspective, and here is what we see:

Anheuser-Busch, Heineken, Constellation Brands, MillerCoors, Mahou San Miguel, Kirin, Asahi and the other big players are fully invested and very engaged in the business of craft beer. Collectively they have likely invested over $2 billion into the business of premium beer. That investment will continue. They are also in competition with the mounting number of worldwide independent craft breweries, and they are strong competitors in a space that they have traditionally owned. The competition is healthy and helps to drive innovation and quality throughout the industry.

AB InBev and the other large

breweries that have invested in

premium beer offerings are

helping raise all boats

The evidence shows that the big brewers are not out to destroy craft beer, craft beer drinkers, or craft breweries. Last year Anheuser-Busch became the nation’s largest dollar volume craft beer producer surpassing both Boston Beer and Sierra Nevada in craft-derived revenue.

The systematic plan that Anheuser-Busch has implemented in buying independent craft breweries between 2011 and 2017 is likely over. Adding to their portfolio through the acquisition of SABMiller makes Anheuser-Busch the undisputed king of craft. Yet the craft beer community is needlessly being led into battle against AB InBev who is actually helping the industry make headway toward what we need most: growing the premium craft beer market share. Should we follow the BA, engaged in industry in-fighting and craft maxing out at 18-20% market share, or should we instead push craft forward toward 50% market share of the beer market?

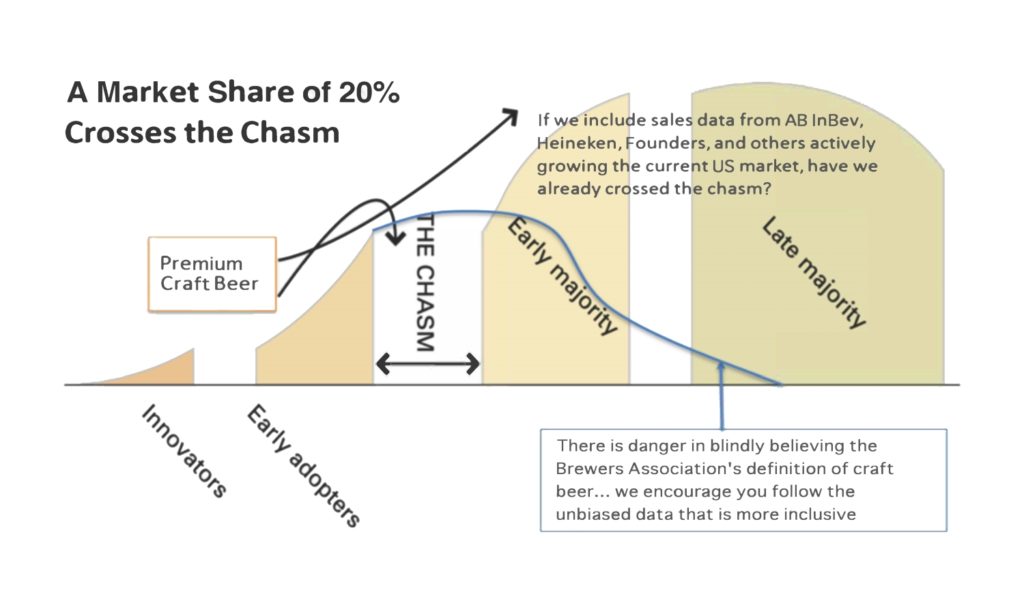

Portland Kettle Works isn’t the only company that thinks the Brewers Association has painted themselves into a corner. The members of Crafting A Strategy (CAS), a global online community of beer business entrepreneurs of which PKW is a member, recently spoke out against how the ever changing and narrow definition of “craft” from the Brewers Association is misleading and potentially dangerous. In an October 2018 blog, CAS President Sam Holloway and V.P. Mark Meckler noted that AB InBev, Heineken, and Mahou San Miguel were using their vast resources and marketing expertise to convert the 85% of non-craft drinkers in the USA into craft drinkers. These breweries are working hard to bring in more craft beer drinkers, but their contributions to the overall premium craft beer market share are not counted in the BA definition. CAS suggests that we are closer to a 20% craft market share and this is a tipping point where we can quickly accelerate market share toward as much as 50% by 2025. CAS’s logic, borrowed from innovation diffusion logics, is depicted in the figure below. Whereas the BA’s definition of craft suggests we are maxed out, CAS and PKW believe we are on the cusp of widespread market growth if we are wise enough to keep our eyes, and our strategy, looking forward.

Growth in business is a measure of success. Stagnation and shrinking market share eventually lead to failure. If craft beer does not grow as a market segment we, meaning craft brewers including AB InBev, put ourselves under siege as we fight over a non-growing business with increasing competition. It is therefore incredibly dangerous to narrowly under-define the craft beer sector. The stakes are high. While the BA is engaged in protectionism, AB InBev is experimenting and redefining the market in an effort to remove barriers to entry for the 80% of non-craft beer drinkers. Independent brewers have a lot to learn from their efforts to grow demand in an increasingly competitive business.

Using BA statistics, 3,743 new breweries opened between 2014 and 2017 which translates to a 116% growth rate. During that same period, market share for craft beer, as defined by the BA, grew just 4.9%. This is equivalent to 30% growth per year in brewery openings against 1.3% growth in market share. This is a serious problem, but only because of definitions inadvertently designed to depress the business of craft beer.

…equivalent to 30% growth

per year in brewery openings

against 1.3% growth in

market share.

This is a serious problem…

Portland Kettle Works makes continuous efforts to define trends that affect our business. While the most recent annual numbers are just now becoming available, they are almost certainly supporting recent historic trends. Here are some recent findings:

- Using publicly available records from the BA, we estimate that from 2014 to 2017 approximately 1.5 million barrels of craft beer were removed from the craft market sector as big breweries bought small breweries

- At the end of 2017 the breweries previously defined as “craft” controlled roughly 4.9% of the overall market share

- When this 4.9% is added to 12.7% “craft” beer share, the more widely defined craft/premium sector becomes 17.6% of the overall market

- AB InBev and the other large breweries that have invested in premium beer offerings are helping raise all boats

It would not be at all surprising to find that craft beer, as defined in this article, is now in 2019 controlling over 25 and possibly as much as 30% of market share. This number feels better. However, it needs to continue growing.

At a recent brainstorming session, our team along with Crafting A Strategy examined what success should look like in the future. Framed in terms of market share, we decided that 50% for craft/premium is a worthy goal. In this moment, the Brewers Association has chosen to lead us into a battle, armed with a well intentioned campaign of “independence”. We absolutely stand with the BA’s effort to promote the importance of American entrepreneurial innovation, grit, and an undying determination to succeed. Given time and enough money, the independence campaign may well move the needle a bit as a small minority of the public that cares to identify and buy our beers over those of large breweries becomes educated. However, in our opinion, this is a misuse of BA resources. This effort will not grow the craft/premium market share one bit. We will remain besieged. Growing craft market share should be our collective and undisputed priority.

About 196 million barrels of beer were produced in the US in 2017. According to the BA definition and statistics, craft beer accounted for about 25 million barrels of that production (12.7%). Adding the premium sector increases that craft/premium piece of pie to 34.5 million barrels in 2017 (17.6%). This means, at 49 million barrels, craft/premium owns 25%, and at 98 million barrels, it is half of the market. How can that not be good for independent craft brewers, even if Anheuser-Busch and other big breweries help to get us there?

This is a future that we can look forward to. A robust environment with a huge, inclusive base of enthusiasts, willing and eager to enjoy high quality, flavorful beers from thousands of innovative independent breweries across the US and, if trends continue, tens of thousands worldwide. A lot of collaborative and rewarding work lies ahead. Rewarding work beats the blues any day.

Cheers,

Thad Fisco

Owner & Founder

Portland Kettle Works (PKW)

You just lost a customer.

Chris – I am sorry to hear that, but if losing a few clients is the price of a better future for craft beer, I’m willing to pay it.

Very best of luck,

Thad & PKW team – great write up. The innovation-adoption tie in is huge. If we are on precipice in the adoption model, the rate of diffusion will increase dramatically as we cross the chasm.

This type of thinking is critical in a time where people feel the market is saturated. The more customer conversions we get from big beer will push towards the 50% goal you guys outlined.

Thanks for stoking the fire, Harmon Brewing Co. is focused on producing a great craft product and attempting to grow the Tacoma craft scene! We have 10 breweries and we want to grow ourselves into a great craft beer town like Portland!

Jason – you get it!

Thanks.

i started brewing professionally in 1990, in the shadow of a large budwieser plant. on many occasions i would find petroleum grease in the valve stems of our kegs in local taverns. i have been dealing with a ‘davy versus goliath’ scenario ever since. these large breweries are off millions in barrels of production due to the hard work of us folks in the ‘craft industry’…

make no mistake, these companies which are the largest of their kind IN THE WORLD, do NOT want to JOIN us…rather they want to consume us…i have almost 30 years in the industry and nothing i see now changes the way i feel about this. if you feel you can work with them so be it but i think you should talk to Mr. Dick Cantwell…

Hi Vincent

Thanks for the posting.

My hope is that a meaningful conversation gets started around the topic. We should all be concerned with entrenchment and how we move forward as an industry.

I also agree that AB aren’t saints and that they have made a lot of block headed moves. It’s too bad because those short sighted attitudes on AB’s part is stunting progress.

Let’s keep the conversation alive.

Thanks.

“If we don learn from history we are doomed to repeat it.” Winston Churchill. AB drove out the regional breweries (Storz, Goetz, etc…)by coming into their neighborhood and undercutting the regionals pricing until they had to fold. AB could take this hit for the long term gain. They are now buying “crafts” and selling them to bars at a highly discounted rate so as to run the independents out of business. Independents cannot discount their beer this much and remain viable. It’s the same thing as 50 years ago but under a different guise. Phil

Hi Thad, So, to summarize:

– You feel the BA’s definition of craft should move from ‘independence’ to ‘premium’.

– Because defining it as ‘independent’ is limiting, and the BA focuses too much on ‘protectionism’.

– AB/Constellation/Heineken/others have invested $2B in premium beer, and that’s ‘good’ helping to ‘raise all boats’.

– We need to ‘cross the chasm’ because… otherwise craft beer will become ‘depressed’.

If I missed something, please let me know, but based on this assessment, I have to disagree with you for many reasons:

1. AB/Constellation/Heineken are operations and finance-driven businesses, not product-driven businesses. They haven’t ‘innovated’ in any meaningful way that is not a cost-saving measure. If they have, please correct me. This is not helping improve quality or innovation in the industry.

2. Since you guys seem to like business school charts, I’ll point you to Porter’s Five Forces, and specifically to ‘Supplier Power’. The big conglomerates use their supplier power every day to crowd out small, innovative, independent breweries (like ours) from retailers. THAT is not raising all boats.

3. All of the large conglomerate breweries engage in heavy lobbying at the local, state, and federal level to tip the scales in their favor, for example: trying to force breweries into a three-tier system, making it easier to fund draft systems for on-premise accounts to lock out independent breweries, allowing manufacturers to provide glassware, signage, etc. as a legal ‘bribe’ that small producers don’t have the scale or resources to provide. Again, not helpful to the industry, the craft, or for consumers.

4. This focus on ‘volume’ growth, like it is the only metric we should be aiming for, is misguided and ill informed. Why shouldn’t we focus instead of ‘revenue’ or ‘jobs’ or ‘quality’? If most US consumers were able to get high quality beer fresh from a local brewery paying their people good wages for honest hard work, I would call that a big win for us as a community, as an industry, and as a country.

I hesitate to question why PKW is going down this path, but let me ask, why are you guys doing this? I am honestly trying to understand the motive here.

Michael

I want to answer your last question first. What is the motivation for doing this?

The owners of Portland Kettle Works and Crafting a Strategy are also owners of breweries. This team is very passionate about craft beer, and the good jobs, growth and the hard-working people that make it.

Short answer:

1) Because there is this other set of real and important facts that is being ignored

2) We are inadvertently casting a shadow over the industry by focusing on only one contributor to the sector

3) The narrative and focus needs to change or there will be serious consequences to all of our businesses

Long Answer:

In the context of this discussion we are doing our best to view the business of craft beer from an objective viewpoint, as devoid of emotion and politics as possible. Through that lens, the only thing that matters is the well-being of the stakeholders in the industry. The current BA definition and misleading statistics stand to damage the industry in ways that are almost completely ignored in the current conversation.

If negativity permeates the conversation around craft beer, we will find that forces outside of our business will listen and react accordingly. Landlords will be less inclined to lease to breweries, and maybe move to more enticing tenants like marijuana businesses, banks will tighten lending standards, and pile covenants on loans with higher interest rates, an outcome that will affect every part of the industry. New entries in the form of innovative and energized entrepreneurs will move away from the business.

Times have changed. Our problems are shrinking market share, wine, weed and spirits, and the total lack of a strategic plan to deal with a host of market forces that are only now becoming known. What happens when weed is legal in 30 or 40 states and an edible replaces a few beers?

To your points;

1-The big players are definitely innovating the business model and encouraging more people to drink craft beer. Sam, Mark and Joe at Crafting a Strategy have some very insightful articles that discuss how breweries like Founders are changing the game. Sure, the big guys have the weight to throw around, and they are using some of it to rocket adoption rates to new levels. Brand loyalty is not what it once was, in fact some have argued that it is dead. Higher adoption rates for craft beer regardless of who makes it will mean higher revenues for independent breweries. You can’t (nor will you ever) buy a Lagunitas at our taproom, but you can buy a hell of a good IPA. Bring a Lagunitas IPA drinker to our taproom any day and we will turn them into an IPA drinker. Over 7000 breweries across our country should be aiming at that target.

2- I called in the big guns for this one. Sam from Crafting A Strategy provided this response.

Porters 5 forces is a great way to examine static industries with very stable supply chains. It’s possibly the most influential framework in the last 50 years and very prominent way of thinking in business schools and among all large businesses that are focused on incremental innovation, driving down costs through bargaining power, and delivering shelf stable and profitable / durable goods to market. It also is the right way to think if you are already a large brewery and leveraging the five forces to make a brewery like 10 barrel more profitable via your bargaining power advantages.

However, in a dynamic and every changing industry that is based upon innovation, solely using Porter’s 5 forces way of thinking means you have to get big to survive. We believe staying small is the best way to grow. Taproom sales, brewpub sales, and selling beer away from grocery store aisles removes the advantages from the five forces. It also (we realize) removes scale advantages. But for the 7,000 plus small breweries in the country who don’t grow through scale/wholesale, they can enjoy 30% growth each year and create incredible and personal relationships with consumers.

These smaller breweries need industry data that accurately shows growth in premium beer drinking occasions. If we solely rely on the current BA definition, banks will stop lending to an industry that isn’t growing. Since nearly all of the 7,000 small breweries in the USA rely upon banks for part of their funding, shouldn’t we have a market growth and market share dataset that represents accurately the number of new people entering the premium beer segment?

3- I agree there are a lot of shitty tactics being employed by the big guys. I’m NOT defending those activities in any way. Phil Knight, founder of Nike said “Business is war without the bullets”. Our business is living proof.

Entrepreneurs’ excel at running circles around entrenched, larger, better funded competitors. Independent brewers, being entrepreneurs, have disrupted the business. In the case of craft beer, the entrenched players didn’t just roll over and die, as is often the case in such instances. We have entered a new phase. I certainly don’t have all the answers, and feel that good discussion will help us develop well-reasoned strategies that help us face the very real challenges that lie ahead.

4- Great points. You and I agree 100%. I would add that a growing market creates an environment rich in opportunities for increased revenue, and increased cash flow. That environment is one in which well-run businesses thrive and drive quality, wages, opportunities for innovation, and so on. A stagnant or shrinking market does the opposite, creating hyper competitive environments where pressure mounts on every metric you list.

I would hate to see the beer industry stunt its growth opportunities because it’s driven itself into a depressed state. This is a very real possibility as external forces make decisions on our access to capital, lease space and new entrepreneurial entrants consider the prospects for a business that appears have seen its best days.

The stakes are high.

Thank you for the measured response. I wish everyone would put thought into the subjects as you have

It seems to me PKW doesn’t really understand craft beer, independent breweries or the new beer consumer. The growth of craft beer didn’t stem from small breweries making premium beer, but from the consumers desire to have a product that was “crafted” by passionate individuals. Craft beer is not the same thing as premium beer. Case in point Devil’s Backbone Brewery in Virginia was acquired 3 years ago by AB. Learning from there past mistakes AB took a more hands off approach keeping the brewery location and retaining much of the staff. Over the past several years the quality of there beer has even improved and is definitely a premium product. However, they have not created an innovative beer since then. Even there new branding looks like it was created by a comity. AB’s growth driven business model is forcing them to churn out just the beers the sell the fastest.

While I don’t agree 100% with BA’s definition of independent, the term is perfect. Independently owned breweries are in the position to have a product and service driven business model. This means they will continue to pour there passion into there business. They will also continue making the beer they want and not the beer that the sales and marketing team wants.

Ken –

It’s good that the big players are not on top of product innovation, but are on top of marketing innovation. It’s unlikely that they will ever translate a revolutionary concept to market. Our, yours and my, business is to deliver revolution to the early adopters, then sell as much craft beer to an eager general public as possible. A growing pool of receptive drinkers is a big plus. Do you believe that more craft beer drinkers is a good thing?

We all want more customers, but the questions you are trying to answer here are, how does the craft beer industry move forward successfully and what is the BA’s role. The BA has struggled over two questions for a while now, “What is craft beer and what does the future of craft beer look like?” It sounds like you believe craft beer to be any beer that is made with high standards and that your vision of the future is craft brewers being supported financially or otherwise by large corporations.

I am not arguing against working with AB. I have worked with several people in AB and they are definitely focused on raising the the average bottle price to increase revenues. And they could be great allies, but I don’t believe this should be the BA’s focus.

So far I like the BA “independent” approach and I want them to keep fighting for the small guys. What does the future hold? I would love to see on premise consumption increase to 70% of beer sales. Currently it is about 20-30%. And that means more small breweries serving the local communities. My customers are looking for an experience, not just a good (ie premium) beer. Our brewery provides a great place for people to gather and socialize. I believe this is where the growth in the industry will come from. And this is what I want the BA should be fighting for.

No, I would not say that I am a proponent of independent brewers being supported by the big breweries. I do feel that it’s time to look at the future and decide collectively if we can be strong as an industry, supporting every iteration of the business model. What that looks like is unclear, but I am enjoying moving the conversation forward with guys like you. Our industry numbers appear depressed and we are not delivering a clear, concise, and positive message to the world, because we cannot work productively together. More inclusive definitions is a starting point, or if that isn’t possible, we at least need to call a spade a spade. As I have stated elsewhere, this is not good for any brewery, large or small. But, this is all very high level.

On the opposite end of the spectrum, I could not agree more wholeheartedly about the value of experience, and how the taproom defines your brand, and that experience brings people back. This is what we encourage our clients to leverage. Our advice is always to begin by building your brand close to home. The market will tell you when it’s time to grow.

It seems something was lost along the way in the article, but I think I understand where Thad is coming from. I don’t think it’s about reclaiming the millions of barrels from ABI takeovers, but rather using them to draw some of the 80% into craft beer. The pull vs. push approach. I think that’s an optimistic view, but not unrealistic. The big questions are: 1) does this work? 2) how well does it work? 3) what’s preventing it from working/working well?

What gets lost in the numbers and stats is that if someone orders a Honkers Ale at the ball game, likes it and says, “hey, that was good. Maybe I’ll try the brewery down the street this weekend and see what they have.”

I have little doubt that ABI et al want to take over as much of the beer market as possible, taking no prisoners. It seems Thad is expressing that there may be another, perhaps more effective, way of responding besides attacking back. Like something “Sun Tzu-y”. One way is to separate the problem (ABI) from the person (their customers).

For instance, let’s return to the possible-real person above; should we ridicule them for ordering a Honker’s, or encourage them to try it and see how they like it—maybe offer some recommendations (without being passive aggressive)? I think back to the “Don’t be Afraid of the Dark” Michelob commercials of the ‘80s—did those convince some people that beer can be more than fizzy yellow stuff?